Ad An in-depth introduction to how EAs can successfully support the post-merger phase of MAs. Its assets and liabilities.

Why Hiring Mergers And Acquisition Firms Is A Pretty Good Idea For Companies Looking For Growth Financial Advisory Merger Business Valuation

It is also a handy book for entry level legal practitioners who require an easy to understand guide to the business aspects of MA.

. Mergers and acquisitions essentially entail a sale and purchase transaction between a buyer and seller for an entity business or asset. Limitations of MA in Malaysia. The complexity of the transaction volume of documents and type of approvals and consents involved are the main differences between public and private company acquisitions.

According to a government ordinance the following industries are prohibited to do the foreign. In Malaysia the Securities Commission is responsible for implementing guidelines for regulating mergers acquisitions and takeovers involving public companies. The regulations for the insurance banking and finance sectors are mainly the responsibility of the.

In addition the Malaysian economy also faced increased pressures from concerns over political uncertainty. Mergers and acquisitions MA in Malaysia are primarily governed by the following laws. MERGER and acquisition MA activities in Malaysia are expected to mirror the growth trends seen globally albeit lagging behind driven by rising needs for transformation to ensure a sustainable future post-pandemic according to EY Ernst Young.

Stakebuilding for public companies is regulated by the Code on Takeovers and Mergers 2016 Rules on Takeovers Mergers and Compulsory Acquisitions and the. Completed mergers and acquisitions MA in Malaysia to 254 in 2014 from a high of 338 in 2013. MA and corporate restructuring represent an important aspect of the corporate finance world.

The sample consists of. EY Malaysia strategy and trans-actions leader Preman Menon said the Covid-19 pandemic has. Merge with an existing company.

The acquisition of public companies in Malaysia is generally subject to a specific process of biding preceded by a takeover offer which may be mandatory or voluntary. There is no statutory concept of a merger in Malaysia and a merger typically involves an acquisition of a business ie. Every day specialized firms and investment bankers around the world arrange MA transactions which bring separate companies together to form larger ones.

Malaysia does not impose a capital gains tax on MA transactions except for the transfer of land or real estate. The Malaysian Code on Take-Overs and Mergers 2016 Code read together with the Rules on Take-Overs Mergers and Compulsory Acquisitions 2016 Rules both effective as of 15 August 2016 treat schemes of arrangement as a takeover under the Rules. Mergers and acquisitions essentially entail a sale and purchase transaction between a buyer and seller for an entity business or asset.

Mergers and acquisition MA in Malaysia consist of several types of transactions and strategies employed by corporations for the purpose of integrating acquiring and controlling other businesses. In October 2019 research and consultancy firm Oxford Economics expected the number of mergers and acquisitions MA transactions in Malaysia to increase up to 221 deals in 2020 from an expected 218 deals in 2019. This was a noticeable increase from the total number of 254 deals.

The complexity of the transaction volume of documents and type of approvals and consents involved are the main differences between public and private company acquisitions. In this regard the announcement made in the budget speech for the fiscal year 201920 Nepal Rastra Bank has sought commitments from the commercial banks for their readiness to go for. NBI is pleased to announce program on Merger and Acquisition Learning Expedition in Malaysia in association with Malaysian Institute of Management MIM.

Mirroring the poor market sentiments we saw a significant 25 drop in the number of competed mergers and acquisitions MA in Malaysia to 254 in 2014 from a high of 338 in 2013. When structuring a transfer of business or transfer of assets from a tax perspective Income Tax Capital. Although 2015 saw a slight uptick in MAs the completed MAs in 2016 was the lowest over the past five years at 236 with a reported value of RM343 billion versus a reported value of RM681 billion at the peak in 2012.

MERGER and acquisition MA activity in Malaysia fell for the third consecutive year in 2020 hurt by the impact of the Covid-19 outbreak. Companies Act 2016 CA which is administered and enforced by the Companies Commission of Malaysia Registrar of Companies. Feb 10 2022 In 2021 the total number of mergers and acquisitions MAs deals in Malaysia amounted to approximately 384 deals.

This study investigates the impact of merger and acquisition announcements on stock prices of biddi ng firms and target firms in Malaysia u sing an event-study methodology. Completed MA in Malaysia. A Comprehensive Step-by-Step Approach is the perfect companion for businesses and professionals who require a better understanding of the MA process in Malaysia.

Merger and Acquisitions Services in Malaysia. Everything about what is a Post-Merger Integration possible challenges and much more. Mergers Acquisition in Malaysia.

The CA regulates private and public M. Merger and Acquisitions Services in Kuala Lumpur our services include strategy development corporate valuation financial consulting pre- and post-merger evaluation and due diligence works. Acquisition of assets and liabilities.

Experts have mixed views as to whether there will be a revival in dealmaking in the first half of this year.

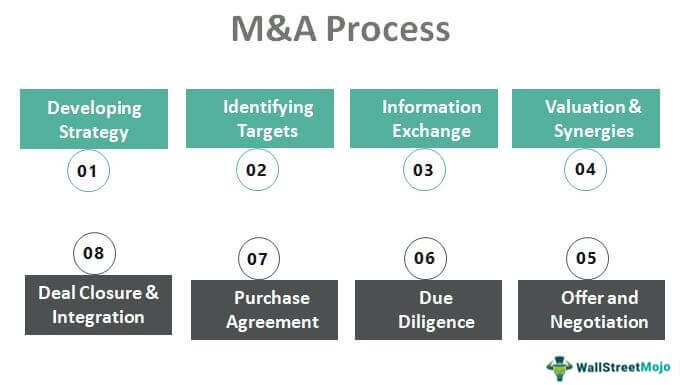

M A Process Top 8 Steps In The Merger And Acquisition Process

The 7 Biggest Mergers And Acquisitions

.jpg)

Top 10 Reasons Why Mergers Acquisitions Fail

11 Biggest Mergers And Acquisitions In History Top M A Examples

How To Register A Company Name Full Guidelines For Company Name Selection Confusing Words Company Names Business Rules

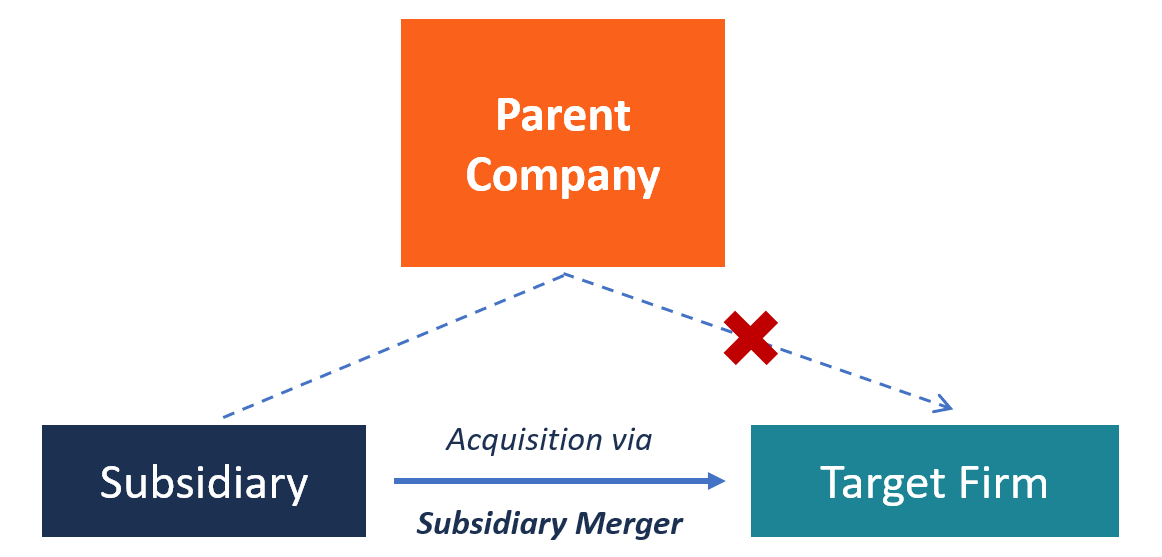

Subsidiary Merger Overview Types Pros And Cons

Steel Industry Financial Tombstone The Corporate Presence Tombstone Steel Financial

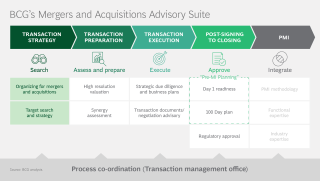

M A Mergers Acquisitions Strategy Consulting Bcg

How To Register A Company Name Full Guidelines For Company Name Selection Confusing Words Company Names Business Rules

Singapore Stock Market Picks Today Sgx Stocks To Watch Keppel Raffles Medical China Fishery Stocks To Watch Stock Market Medical

11 Biggest Mergers And Acquisitions In History Top M A Examples

Mergers Acquisitions M A Advisory

M A Statistics Transactions Activity Worldwide Imaa Institute

Singapore Malaysia Stock Market Picks Sgx Klse Stock Market Forex Signals Singapore Malaysia

10 Benefits Of Mergers And Acquisitions You Should Know

How To Apply For Malaysia Evisa From India Kuala Lumpur Beautiful Scenery Pictures Petronas Towers

Incorporation Of Bvi Company Paul Hype Page Cert Bvi Seal

Acquisitions Examples Top 4 Practical Examples Of Acquisition